Mastercard® Business Bonus Rewards Card

Rewards

Earn Rewards

- Earn 1 point for every eligible net $1 you spend.

- Get a 50% bonus on all points earned every month, automatically.

- You can also earn up to 5X points on prepaid hotel and car rentals when booked directly through the Rewards Center.1

- There are no caps or limits on the points cardmembers can earn.

More Rewards

- Earn Mall — Earn additional rewards while shopping online at 1,100+ stores using your Business Card.

- Real-Time Rewards — Instantly turn your business purchases into rewards. Enroll in Real-Time Rewards and use your mobile device to immediately redeem toward a credit card purchase.

- PayPal — Shop the millions of sites that accept PayPal and enjoy the convenience of faster checkouts and secure payments! Simply link your card to PayPal and set up as your preferred PayPal payment.

Redeem Rewards2

To redeem rewards:

- Log in to Account Access.

- Select your Account, and within the top navigation select “Rewards & Benefits”.

- Click “Redeem rewards at Rewards Center” to reach the rewards center and start redeeming.

Or call the number on the back of your card to reach Cardmember Service.

- Redeem for travel rewards, cash back3, gift cards or name brand merchandise.

- Redemption starts at 2,500 points for $25 cash back.

Service Benefits

24/7 U.S.-Based Customer Service

Our dedicated specialists are available 24/7 to assist you with any account questions.

Call the number on the back of your card.

Lost/Stolen Card Reporting

Our dedicated specialists are available 24/7 to assist you with a lost or stolen card. Call Cardmember Service immediately - available 24 hours a day.

Consumer cards: 1-800-558-3424

Business cards: 1-866-552-8855

International (Collect): 701-461-1556

Fraud Protection

Our sophisticated fraud-monitoring tools look for abnormal spending patterns. If we see something unusual, we move fast to help keep your card and account information safe. We provide zero fraud liability4 for unauthorized transactions. If you notice any charges you did not make, please notify us promptly by calling the number on the back of your card. Certain conditions and limitations may apply. Learn more

Emergency Card Replacement and Cash Disbursement

Our 24/7 worldwide service allows you to quickly and easily get a replacement card sent to you and/or receive emergency cash at a convenient location.

Call the number on the back of your card.

Contactless Payments

Pay with a tap. Use your card for contactless payments wherever you see the Contactless Symbol and your payment is processed in seconds. You enjoy the same chip security whether you tap or insert your card. Cards are embedded with a microchip that adds an additional layer of security. If a terminal is not yet contactless-enabled you can insert or swipe your card as usual. Learn more

Card Benefits

View Mastercard Business Guide to Benefits (PDF) Certain terms, conditions and exclusions apply. Please refer to the Guide to Benefits for further details and full terms and conditions

Travel

- MasterRental® Car Rental Collision Damage Waiver Insurance

Save money and enjoy peace of mind. Receive coverage, at no additional cost, for damage due to collision or theft when renting a car. Just charge your entire rental transaction to your card and decline the rental company's collision damage waiver. Coverage is provided by New Hampshire Insurance Company, an AIG company. Policy provides secondary coverage in certain circumstances. Certain terms, conditions and exclusions may apply.5

To make a claim, visit our website - More information on the MasterRental car rental collision damage waiver insurance or call 1-800-Mastercard (1-800-627-8372), en español 1-800-633-4466

Business Offers and Tools

- Mastercard Easy Savings® Program

Use your business card to save on qualifying purchases at participating merchants. Your savings appear automatically as a credit on your future account statements.

Enroll today - Intuit® Small Business Financial Tools

Your Business Mastercard brings you exclusive discounts on Intuit® small business financial tools. Save 30% on QuickBooks® Online, QuickBooks Self-Employed or QuickBooks Online Payroll for 12 months.6

Visit quickbooks.intuit.com/partners/mastercard Save 20% off TurbTax®. Visit turbotax.com/affiliate/mastercard1

For current offers and terms and conditions visit mastercard.us/businessoffers.

Protection

- Mastercard ID Theft Protection™

Identity theft hurts, but Mastercard can help–for no extra cost. From scouring the internet to see if your personal info is being sold to helping you clear your name with credit rating agencies, we are there for you 24/7. Simply visit mastercardus.idprotectiononline.com or call 1-800-Mastercard.5

Card Tools & Controls

These tools and resources can help you manage your account and take advantage of everything your card offers. Each section contains details on important card features and provides answers to commonly asked questions.

-

Account Management

Create administrative access levels that determine who can do what with your account.

-

Account Setup and Billing

Set up your account and billing process to fit the needs of your organization.

-

Payments

Choose from five different ways to make card payments.

-

Credit Limit

Set up your company credit limit and spend limits for your employees.

-

Credit Card Account Access

Online tools to help you manage your card program from almost anywhere, 24/7.

-

Online Reporting

Monitor and analyze business credit card spending with valuable reporting tools.

« Back to Card Tools and Controls

Account Managment

Your business card account is designed to help you easily manage your business, whether you're a small business or a larger organization. Set up different levels of administrative access to your account for greater control.

Authorized Officer

Within your organization, the Authorized Officer is typically the:

- Business owner

- President

- Partner

- Vice President

- Treasurer

They have full authority to make any updates, changes or requests for the business credit card account(s) within the company. The Authorized Officer is required to be a cardmember, and is liable for the account.

Authorized Representative

The Authorized Representative—typically an office manager, controller, or someone in accounts payable—is given the authority to perform many administrative tasks on behalf of the Authorized Officer or company, such as:

- Updating company account information

- Adding or closing employee accounts

- Adjusting employee credit limits

- Making a payment or requesting statements

The Authorized Representative is not required to be a cardmember.

Employee Cardmember

You can provide your employees with company business cards to help them efficiently track their business purchases, including client entertainment, travel expenses and more.

Every employee will have a unique credit card account number and separate spend limit as designated by the Authorized Officer or Authorized Representative.

Who Can Do What?

This chart provides you with details on administrative roles and responsibilities in your business card program. An Authorized Officer must be assigned to an account and the account must be in good standing to process most maintenance requests.

(All Accounts)

(All Accounts)

(Individual Account Only)

Answers to top questions

You can set up, change or remove an Authorized Officer or Representative by calling the Cardmember Service number on the back of your card. You can also log in to myaccountaccess.com and under "Services" select "Add Authorized Representative" to view a PDF with instructions.

Only one Authorized Officer is allowed. You can have more than one Authorized Representative.

The Authorized Officer or Authorized Representative can call the Cardmember Service number on the back of the card to set up employee business cards over the phone. You can also set up employees through myaccountaccess.com or the mobile app (under Services).

« Back to Card Tools and Controls

Account Setup and Billing

You can set up your business card account billing in one of three ways: Central Bill, Central Bill with Memo Statement or Individual Bill. Choose the option that's right for your organization. Your account will automatically default to a Central Bill Account. For a product with rewards, pooling is used to accumulate and award rewards points to the Central Bill Account rather than the individual account; meaning employees under the account will not earn or redeem rewards. With an Individual Bill Account, rewards are earned and redeemed at an individual level.

Central Bill

Central Bill links all credit cards in your company together, helping you to better manage your expenses. Details on Central Bill:

- The Authorized Officer can view and track all transaction activity for each business card account, as well as manage payments.

- The Authorized Officer receives a consolidated statement that lists all of the Employee Cardmember transactions and is responsible for making the payment.

- Employee Cardmembers do not receive a statement. While employee cardmembers are able to spend on an account, the earn from that spend rolls or "pools" to the Central Bill Account. Only the Authorized Officer is able to view and redeem rewards.

Central Bill with Memo Statement

This billing method allows Employee Cardmembers to see their monthly spending activity. Here's how it works:

- The Authorized Officer continues to receive a consolidated statement that lists all of the Employee Cardmember transactions.

- Each Employee Cardmember receives a memo statement detailing their individual expenses. The Authorized Officer is still responsible for making the statement payment. While employee cardmembers are able to spend on an account, the earn from that spend rolls or "pools" to the Central Bill Account. Only the Authorized Officer is able to view and redeem rewards.

Individual Bill

With Individual Bill, the Employee Cardmember has more responsibility:

- Each Employee Cardmember receives a monthly statement that lists their individual expenses.

- The Employee Cardmember is responsible for making the payment by the due date listed on the statement.

- A unique credit card number is assigned to each Employee Cardmember, including the Authorized Officer.

- Rewards are earned on each individual card (if applicable).

Answers to top questions

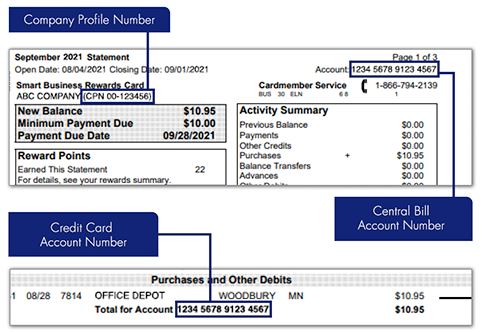

If your account is set up for Central Bill, your business card account is set up with one Central Bill Account Number that is assigned to your overall account. That account number is only used for billing management and it is not a credit card number.

Each individual cardmember on your account has their own unique credit card number, which makes it easy to track spending and manage the accounts online. A unique Company Profile Number is also assigned to your business; however, it is only used to confirm account information.

Here is where the Company Profile Number, Credit Card Account Number, and Central Bill Account Number are located on a Central Bill:

« Back to Card Tools and Controls

Payments

Your company can choose between five convenient ways to make your business card payments.

AutoPay

AutoPay makes it easy and convenient to automatically pay your credit card bill from your company checking or savings account, saving you time and eliminating potential mail delays.

To sign up for AutoPay:

Visit Credit Card Account Access at myaccountaccess.com

Visit Credit Card Account Access at myaccountaccess.com Call the number on the back of your card

Call the number on the back of your card Download the mobile app, choose "Payments" and then "Set up AutoPay"

Download the mobile app, choose "Payments" and then "Set up AutoPay"

Important note: It takes about 10 days to activate AutoPay, so be sure to pay the amount due on your most recent statement by mail, phone or online. It may take up to two billing cycles before AutoPay starts.

Pay Online

It's easy to pay online:

- Go to Credit Card Account Access at myaccountaccess.com.

- Log in and navigate to "Manage Payments" and "Make a Payment".

To pay via the mobile app:

- Log in and choose "Payments" (in Payables account).

- Choose "Make a Payment".

Pay By Phone

Single payments can be made by phone. Call the number on the back of your card for assistance in setting up your Phone Pay Account.

Pay By Mail

Submit your payment using the coupon and envelope in your monthly statement.

Pay With Your Mobile Wallet

Add your card to your mobile wallet, then pay your bill using Apple Pay®, Google Pay, Samsung Pay™ or with other digital payment options.

Answers to top questions

Payments received by 7 p.m. Central Standard Time (CT) on normal business days are applied on the same day. Payments received on Saturdays, Sundays, or holidays will post the next business day. Any payment received after 7 p.m. CT on the due date will be assessed a late fee.

Central Bill: Yes, you may send in a payment before the due date on your statement. The payment will apply to the current company balance and free up your available credit for the month. Multiple payments can be made in a statement cycle, however each card credit line will only refresh to twice the amount of their credit line. So as an example, if the card has $2,000.00 credit line and makes one or multiple mid cycle payments, the credit line will cap at $4,000.00.

Individual Bill: Cardmembers can make multiple payments to individual bill accounts throughout the month and the account will refresh after each payment.

If your billing method is Central Bill, the Authorized Officer or Authorized Representative can view minimum payment due information in the central bill account under "Payables Account" in the Servicing section.

« Back to Card Tools and Controls

Credit Limit

Your cardmember program includes spend limits and payment controls that you can set for both the company and/or employee, depending on your account type. The Authorized Officer can request an individual cardmember's spend limit be changed at any time.

Central Bill Accounts

Central Bill Accounts have a credit limit for the entire company, while each Employee Account assigned to the Central Bill Account has an individual spend limit as determined by the Authorized Officer.

Individual employee spend limits can be adjusted from $100 to the maximum of the company credit limit.

Important note: The sum of all employee spend limits may exceed the company credit limit. See the example below:

The company will not be allowed to spend past its credit limit; nor will an Employee Cardmember be allowed to spend past its assigned spend limit. Therefore, once the sum of all cardmember spending has reached the company credit limit, the Authorized Officer should make a payment so that all cardmembers will be able to continue to use their cards.

Individual Bill Accounts

Individual accounts are assigned a credit limit that is unique to the individual employee.

Payment Controls

Payment controls allow you to customize each employee's business card to control where, when, and how your employees use them. This helps to minimize your company's risk, while giving your employees the freedom to use their cards appropriately.

Easily set controls that limit card use by:

- Time of day or day of week

- Geographical location—both domestic and international

- Merchant type—for example the ability to allow "gas station only" purchases

- Transaction dollar amount limits

- Transaction types, such as cash advances or cash withdrawals

To set up customized controls, log in to myaccountaccess.com.

Answers to top questions

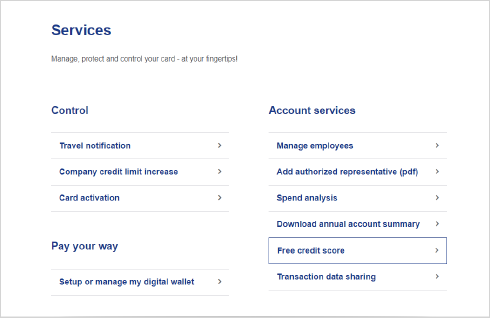

You may request a company credit line increase by calling the Cardmember Service number on the back of your card or filling out a form available through the Services section of Credit Card Account Access within your financial institution's website.

This can also be done in the mobile app under "Services".

For company credit line increases:

- Click "Control", then "Company Credit Limit Increase"

- Click "Account Services", "Manage Employees" and then "Request a Credit Limit increase for your company".

For increases over $25,000 of the total credit line, two years of recent financial statements are required, as well as the following information:

- Required: Accountant-prepared balance sheet and 12-month income statement from the most recent two fiscal years, or two years of company tax returns. Interims also required if statements are over four months old.

- Preferred: Audited financials, three years of financials cash flow statements and tax returns.

Employee spend limits may be adjusted by calling the Cardmember Service number on the back of your card, or through the mobile app. Log in, and under "Services" click on "Manage Employees", then "Edit Spending Limit".

« Back to Card Tools and Controls

Credit Card Account Access

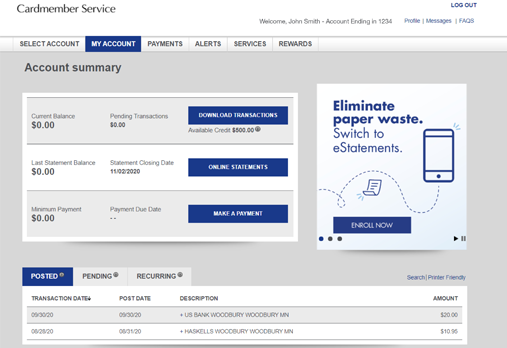

The Credit Card Account Access website provides you with easy-to-use tools that can help you efficiently manage your account online from almost anywhere, 24/7. Log in at myaccountaccess.com or through the mobile app to get started.

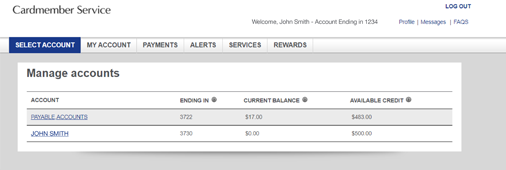

Manage Accounts

This page summarizes all of the account holders within the central billed account.

- Authorized Officers can view all cardmember accounts and transaction details.

- Individual Employee Cardmembers can view a summary of their own accounts.

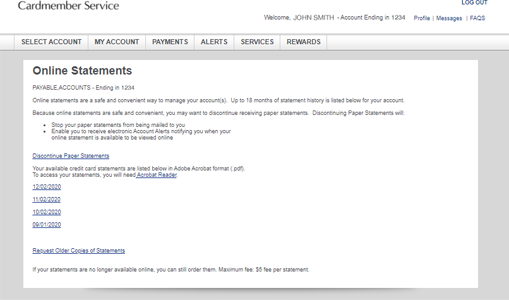

Online Statements

Online statements are a safe and convenient way for the Authorized Officer to manage all employee statements. Employee cardmembers can also view their individual statements (up to 18 months). To view statements older than 18 months, contact Cardmember Service. Or you can access statements through the mobile app under "Services".

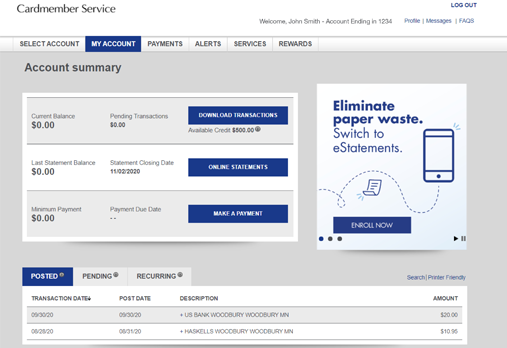

Transaction Details

The Authorized Officer can visit the Account summary page to view and download up to 12 months of transaction activity for the entire account. Employee Cardmembers can view transaction activity on their individual accounts.

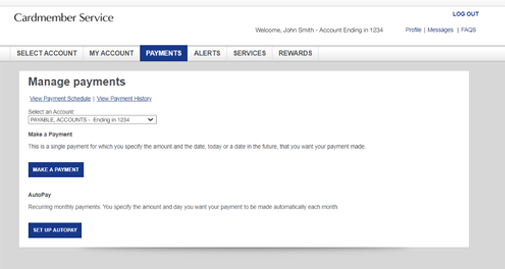

Manage Payments

Your Authorized Officer or Representative can visit the Manage payments page to access two methods of processing a payment:

- AutoPay to specify the amount and day you want your payment to be made automatically each month, or

- Make a Payment for which you specify the amount and the date you want your payment made.

Your employees will always use the single payment option.

You can also access two other features on this page — View Payment Schedule and View Payment History.

Note: Payments made on weekends, holidays, or after 7 p.m. Central Standard Time (CT) will be processed on the next business day.

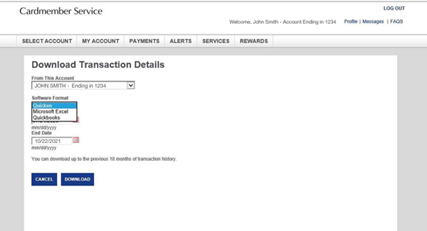

Download Transactions

Access up to 12 months of transaction history. Transactions can download to Quicken®, Microsoft Excel® or Quickbooks®.

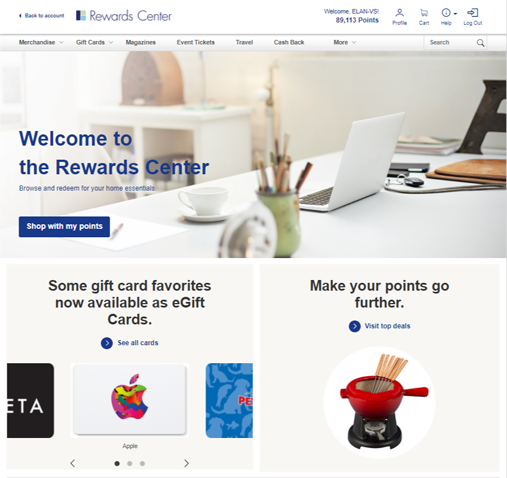

Rewards Center

Accounts enrolled in the rewards program can view the Rewards Center by selecting the Rewards Link on myaccountaccess.com or Services > Rewards through the Mobile App. The Authorized Officer must select the Payables Account to navigate the Rewards Center.

Accounts are able to:

- View the entire rewards website and learn about special points offers

- View point balances in real time

- Purchase or transfer points

- Redeem points for valuable rewards which will vary depending upon the type of rewards card you have. Some rewards options include merchandise, gift cards, travel, and cash back.

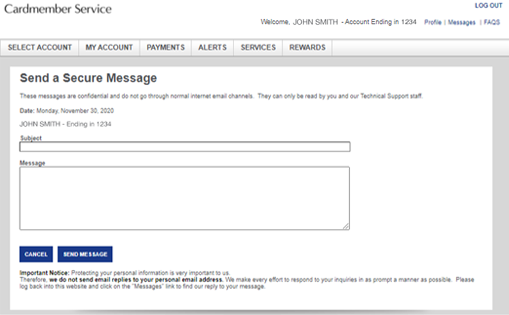

Secure Messages

The Authorized Officer, Authorized Representative or Employee can use this page to email Cardmember Service directly with questions regarding the account.

Email communication is confidential and can only be read by Cardmember Service staff; it does not go through normal email channels.

Cardmember Service

The Services page allows the Authorized Officer to manage various account activities. They can:

- Set up automatic payments

- Request credit limit increases

- Make balance transfer and convenience check requests

- Request statement copies

- Update account profiles

- Access other reporting tools, such as Annual Account Summary

Employee Cardmembers are also able to update their account profiles, request account service, or contact Cardmember Service.

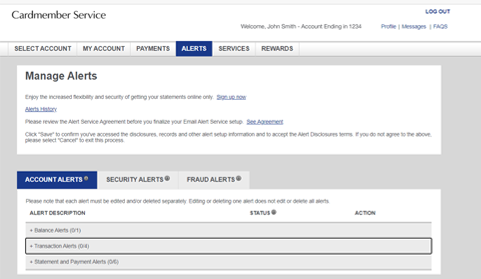

Alerts

This page makes it easy for your team to sign up for timely notification texts and emails when specific events occur within an account. You and your team choose the type of notifications you want and set the parameters for when and how you will be contacted.

The following alerts are available:

Balance Alerts

- Account Balance Exceeds: Learn when the balance of your credit card exceeds the amount you specify.

Transaction Alerts

- Card Not Present: This alert will be sent when a transaction (a charge) has been authorized to the credit card account when the card is not presented, such as a purchase made via the web or over the phone.

- Credit Posted: Learn when a credit (like a refund from a store) is posted to your credit card account.

- Debit Posted: This notification will tell you when a debit (a charge) posted to your credit card account fulfills the criteria you specify. You may set up multiple Debit Posted Alerts.

- Transaction Notification: This alert will be sent when a transaction (a charge) has been authorized to the credit card account based on the criteria you specify.

Statement and Payment Alerts

- AutoPay Scheduled and AutoPay Processed: This alert will be sent when an autopayment is scheduled and when it processes to your account.

- Online Statement Available: This notification will tell you when your credit card statement is available to be viewed online.

- Payment Due: Receive an Alert indicating your credit card account's due date one to 15 business days before the payment is due.

- Payment Overdue: Find out when a payment becomes overdue on your credit card account.

- Payment Posted: Receive notification when a payment is posted to your credit card account.

- Payment Scheduled: This alert will be sent when you schedule, edit or cancel a payment.

Fraud Alerts

- These enable 2-way text messages which allow us to contact you via text message regarding fraud alerts.

Answers to top questions

To enroll in Credit Card Account Access, visit myaccountaccess.com. You will need to provide the following information:

- Account Number, PIN or Zip Code

- Last four digits of Social Security Number

- Signature Panel Code

If you need assistance enrolling, please contact Technical Support by calling 877.334.0460.

You call also enroll through the mobile app.

Yes! Paperless statements are a simple, safe and environmentally friendly way to manage your account, redue clutter, save time and deter fraud.

To sign up for paperless statements:

- Visit myaccountaccess.com and log into your account.

- Click on "Online Statements."

- Click on "Discontinue Paper Statements."

An email will be sent to alert you when your online statement is available. You can discontinue paperless statements at any time.

« Back to Card Tools and Controls

Online Reporting

Your card comes with online reporting tools that let you easily monitor and analyze your company's credit card spending annually.

Spend Analysis and Annual Account Summary

With the free Spend Analysis tool, you can view and monitor your spending organized by category. You can also download a summary report of your annual spending.

Free Credit Score

View your credit score anytime, anywhere in the mobile app or through Credit Card Account Access. It's easy to enroll, easy to use, and free to Elan Financial Services customers.*

Transaction Data Sharing

You can choose to limit the sharing of your transaction data with your credit card partner at any time. "No" in the Opt-in status must be selected in order to prevent sharing transaction history.

Business Reporting Tools

If your card is a VisaŽ Business card, you can also enroll in Visa Spend Clarity, a simple but powerful expense management solution designed for your small business.

Advantages include:

- Customizable reports and dashboards so you can track and compare your business spending

- Receipt capture and transaction tagging to help organize your business

- Integration with QuickBooks Online and Xero so you can easily sync your transactions

- Payment Controls that allow you to limit where, when and how employee business credit cards are used

Click here to enroll today.

*Free credit score access, alerts and Score Simulator through TransUnion's CreditView™ Dashboard are available to Elan Financial Services customers only. Alerts require a TransUnion database match. It is possible that some enrolled members may not qualify for the alert functionality. The free VantageScore® credit score from TransUnion® is for educational purposes only and not used by Elan Financial Services to make credit decisions.

© 2024 Elan Financial Services | Security Standards

The creditor and issuer of this card is Elan Financial Services, pursuant to a license from Visa U.S.A. Inc. or Mastercard International Incorporated.

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

American Express is a federally registered service mark of American Express and is used by Elan Financial Services pursuant to license.

Return to Text

Return to Text

Return to Text

Return to Text

Return to Text

Return to Text

California Privacy Center

We use technologies, such as cookies, that gather information on our website. That information is used for a variety of purposes, such as to understand how visitors interact with our websites, or to serve advertisements on our websites or on other websites. The use of technologies, such as cookies, constitutes a 'share' or 'sale' of personal information under the California Privacy Rights Act. You can stop the use of certain third party tracking technologies that are not considered our service providers by clicking on "Opt-out" below or by broadcasting the global privacy control signal.

Note that due to technological limitations, if you visit our website from a different computer or device, or clear cookies on your browser that store your preferences, you will need to return to this screen to opt-out and/or rebroadcast the signal. You can find a description of the types of tracking technologies, and your options with respect to those technologies, by clicking "Learn more" below.